Business Insurance in and around San Leandro

Calling all small business owners of San Leandro!

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Small business owners like you have a lot on your plate. From HR supervisor to product developer, you do as much as possible each day to make your business a success. Are you a taxidermist, a piano tuner or an HVAC contractor? Do you own a shoe store, an auto parts shop or a travel agency? Whatever you do, State Farm may have small business insurance to cover it.

Calling all small business owners of San Leandro!

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

Your business thrives off your creativity determination, and having reliable coverage with State Farm. While you make decisions for the future of your business and do what you love, let State Farm do their part in supporting you with business owners policies, commercial auto policies and commercial liability umbrella policies.

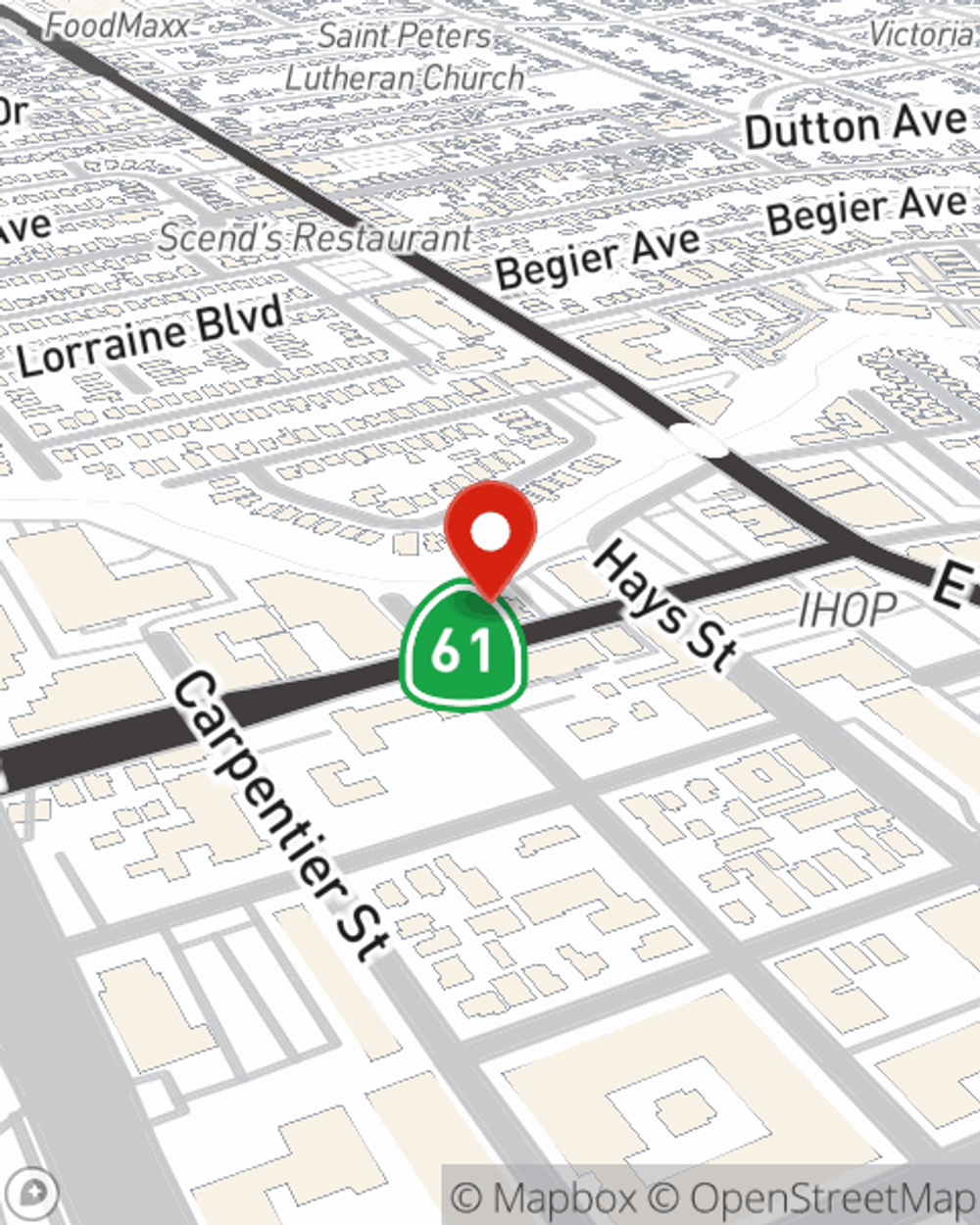

The right coverages can help keep your business safe. Consider getting in touch with State Farm agent Edwin Jasper's office today to explore your options and get started!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Edwin Jasper

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.